When you're fired, protect your FSA

Move fast when you're fired and turn those lemons into lemonade.

This publication was withheld, until I could confirm everything worked and the advice was sound. It was. It was published months after being written.

I had a call at 1:00 PM on a Tuesday: I was terminated. I had seen it coming for a while. Something about it aggravated my back pain. 😉 Before 5:00 pm that day I had purchased an $1,800 Herman Miller chair. This is my story.

An idiot’s guide to an FSA

A Flexible Spending Account or FSA restricts what you can spend your money on in exchange for getting an income tax deduction on that money. For example with a Health Care FSA or HCFSA, if you spend $1,000 a year on medical expenses and are in a 25% tax bracket, you can put $1,000 in your FSA and save the income tax on it ($250). There is one catch: whatever you don’t spend you lose. Keep in mind the following.

An HCFSA is funded in advance at the start of the year. All of your FSA funds are available on the first of January.

Every pay check the company claws back the respective amount from your wages.

When you leave or depart the company your FSA money is refunded back to the corporation.

If you leave before the end of the year and the FSA is exhausted, you’ve won.

If you leave before the end of the year and there is money in the FSA, the company may have won.

At the end of the year, subject to the whims of the administrator and the company they may roll over $650; they may not. I have been bitten by this.

When you depart the company you may or may not have a “grace period.” That may or may not be documented in your plan. Rely on this at your own peril.

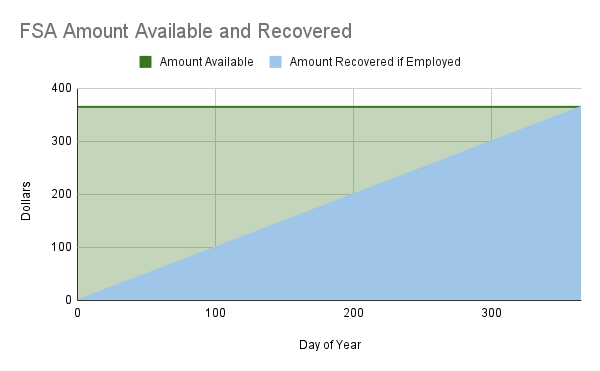

Let’s take a look at the first three points with a graph, here we assume the FSA is set to $365 a year for simplicity.

The green shows you when you’re “in the green:” when most of the money in your FSA is advanced to you. You win if you spend into the green. The blue is the natural clawing back process.

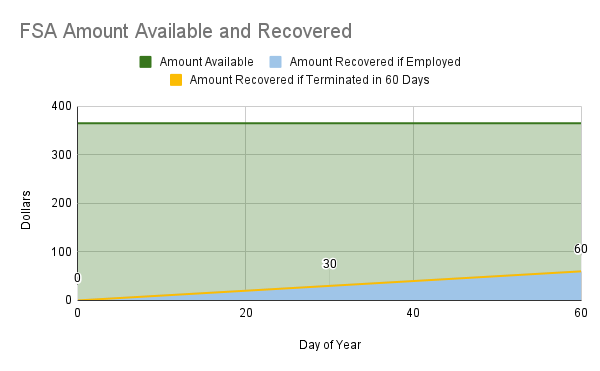

Now let’s say you were terminated 60 days in.

In the above scenario, they can’t possibly recover the full amount available because you were terminated early. But that green is still yours, even if just for the day, week, or month.

A Dependent Care FSA (DCFSA) isn’t funded in advance. But, it serves a similar purpose except for your kids. You can put up to $5,000/yr in it and everyone should. The same stipulation applies: if you’re terminated the company gets to keep the money you’ve allocated in the fund for your kids. Something about this seems especially evil. It is literally a corporation expropriating your kids’ medical funds.

When you’re fired, deplete the funds

When you find yourself terminated, the clock is ticking: act fast.

Put in a claim for the DCFSA funds. Even if it’s just part of the month’s daycare. Use it!

Spend your FSA funds. You’re going to lose them if not

Do you have back pain? If so, anything ergonomic can be considered a necessary part of your treatment. Maybe you have back pain. If not, consider asking about necessary prevention; but, you probably have back pain.

Do you have a Repetitive Strain Injury (RSI) if so, consider an ergonomic mechanical keyboard. Only if, of course, your doctor finds it to be a necessary part of your treatment — which I am sure he will. If not, consider asking about whether or not it’s necessary to prevent RSI.

Have you been losing muscle mass, any strength training equipment can be considered necessary for “physical therapy”? If not, consider asking about prevention; but, you probably have a reduction in muscle mass.

Are you obese? If you are, a treadmill can assist in solving this problem. If not, consider asking about prevention; but, you probably would be healthier if you had the necessary equipment to adhere to physical therapy routine.

You can use the FSAFeds site to determine what is an eligible expense.

How do you do this?

Immediately schedule a physician visit. Get your physical.

Bring a “Letter of Medical Necessity” (legal term) or a “Certification of Medical Necessity” (my specific FSA provider’s form). If your FSA provider has neither, you can use the Letter of Medical Necessity on fsafeds.gov.

Talk about your problems with your doctor.

Ask about treatment, and get them to fill out and sign the “Letter of Medical Necessity” or a “Certification of Medical Necessity.” It should name your condition and treatment explicitly.

Make the purchase on credit.

Get a detailed invoice.

File with FSA provider a claim that includes the invoice and letter.

How I handled getting fired

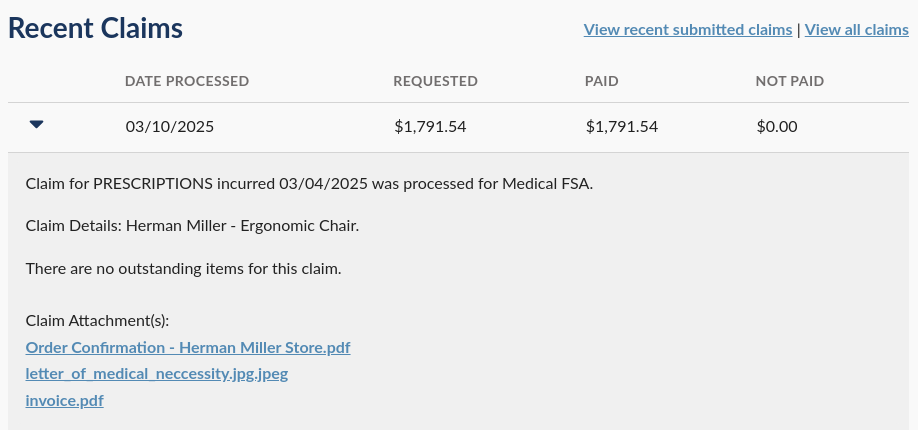

Terminated at 1 pm

Doctors appointment scheduled at 3:20 pm

Chair ordered at 4:00 pm, cost $1,791.54

Claim filed for reimbursement at 4:30 pm

Follow Up

In case there is any question about if this worked, it did! I can’t say it’ll work for you; but, I can say as a matter of fact it worked for me.

Scientific Journal of Objective Truths and Proof 2025:07-24.0.0